RBI Monetary Policy Meeting Live: RBI has decided not to increase the repo rate for the first time in a year. Earlier, it was decided to increase the repo rate in 6 consecutive meetings of the Monetary Committee. Governor Das believes that there is no justification to make loans costlier because of inflation being under control.

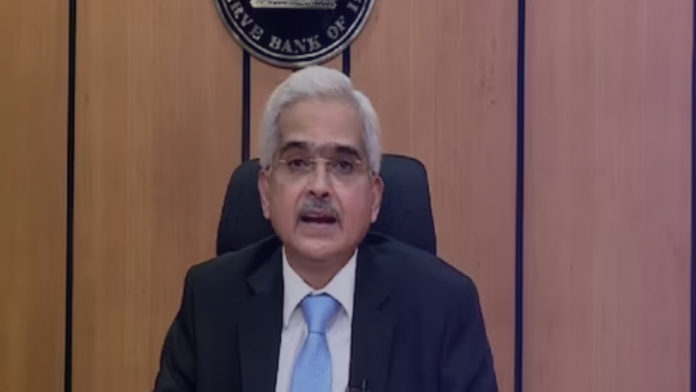

New Delhi. There is good news for home buyers and home-auto loan borrowers. The Monetary Policy Committee (MPC) headed by Reserve Bank of India (RBI) Governor Shaktikant Das has decided not to increase the repo rate for the first time in a year.

After the meeting, Governor Das told that the repo rate will be kept constant at 6.50 per cent. The repo rate has been increased 6 times since May 2022. During this, a total of 2.50 percent repo rate has been increased.

Repo rate is the rate at which commercial banks borrow money from RBI. Most retail loans including home-auto are based on this repo rate. This time, due to no increase in the repo rate, banks will also not increase the interest rates of retail loans, which will directly benefit the home buyers.

Governor Das has said that the repo rate was not increased this time due to inflation being in the comfort zone. However, the US Federal Bank and Britain’s central bank had increased their interest rates in April as well, leading to speculations that the Reserve Bank would also increase the repo rate.

Banks had expressed concern

Indian banks had expressed concern to the Reserve Bank regarding rising inflation and costlier loans across the world. He said that it is not right to increase the repo rate continuously to maintain the balance between inflation and interest rates. However, our work does not end here. If the situation is not under control, then the repo rate can be increased again in the next meeting of the MPC.

Governor Shaktikanta Das said that India’s growth rate (GDP Growth) will increase to 6.5 percent in the current financial year (2023-24), which was earlier estimated to be 6.4 percent .

In the last quarter of the last financial year i.e. 2022-23, the growth rate can reach 5.9 percent. Earlier this rate was estimated to be 5.8 percent. Inflation can also come down to 5.2 percent in the current financial year. Earlier it was estimated to be 5.3 percent.