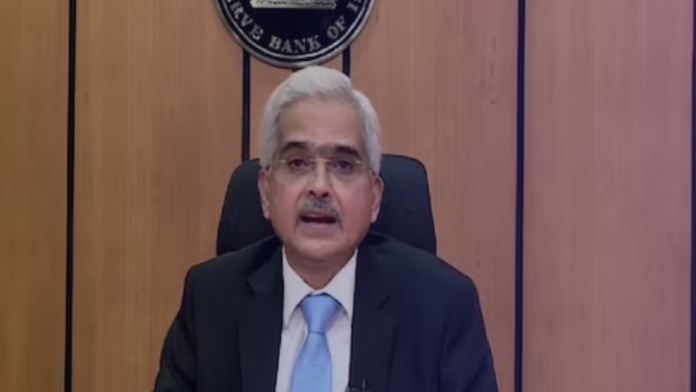

Reserve Bank of India (RBI) Governor Shaktikanta Das at the briefing after the two-day Monetary Policy (MPC) meeting announced the setting up of a secure web desk centralized portal called Prabha to enhance the efficiency of the regulatory process.

New Delhi. Reserve Bank of India (RBI) Governor Shaktikanta Das at the briefing after the two-day Monetary Policy (MPC) meeting announced the setting up of a secure web desk centralized portal called Prabha to enhance the efficiency of the regulatory process. At present, the process of obtaining license, authorization or regulatory approval from the Reserve Bank under various statutes and regulations for entities is both online and offline. In order to simplify and streamline such process, it has been decided to set up a secure web desk centralized portal by the name of PRABHA.

Das further said that this portal will show the time limit for taking decisions on applications or approvals. Apart from this, RBI has also decided to start a centralized portal to track unclaimed deposits in various banks. Banks have a large number of such accounts in which no transaction has taken place for many years. By February 2023, public sector banks have transferred such deposits to the Reserve Bank of about Rs 35,000 crore, in which no transaction has taken place for the last 10 years.

Announcing the results of the first monetary review meeting of the current financial year, Reserve Bank Governor Shaktikanta Das said on Thursday that it has been decided to create a web portal to improve and broaden the reach of depositors and beneficiaries. Through this, unclaimed amount deposited in various banks can be traced.

How much amount is deposited in which bank?

He said that Artificial Intelligence (AI) medium will be used to improve the results of ‘search’. The maximum unclaimed amount of Rs 8,086 crore is deposited in State Bank of India. After this, there is an unclaimed amount of Rs 5,340 crore in Punjab National Bank. Such deposits amount to Rs 4,558 crore in Canara Bank and Rs 3,904 crore in Bank of Baroda (BOB).