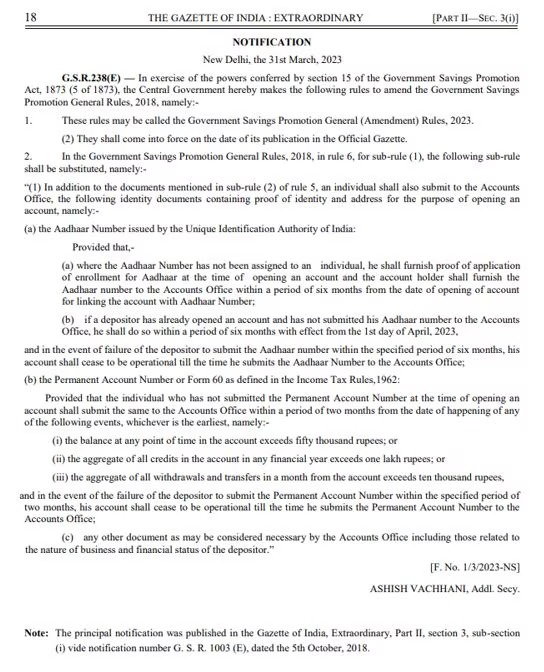

Aadhaar PAN Link: Linking of PAN and Aadhaar has become mandatory for investing in small savings schemes like Public Provident Fund (PPF), Sukanya Samriddhi Yojana (SSY), Post Office Savings Scheme, Senior Citizen Savings Scheme (SCSS), etc. . The Finance Ministry issued a notification in this regard on 31 March 2023.

These changes have been notified as part of KYC for small savings schemes. Prior to this Central Government notification, investment in Small Savings Schemes was possible without submission of Aadhaar number.

But, from now on, investing in government-backed small savings schemes will require at least the submission of an Aadhaar enrollment number. The notification also clarified that PAN card will have to be submitted for investments above a certain limit.

New Rule for Small Savings Scheme

According to the Finance Ministry notification, customers investing in small savings schemes will have to submit their Aadhaar number by 30 September 2023, if they have not submitted their Aadhaar number while opening PPF, SSY, NSC, SCSS or any other small savings account.

Have done so. The notification also clarifies that new customers who want to open any small savings scheme without Aadhaar number will have to submit Aadhaar number within six months of account opening.

If a small savings scheme subscriber has not yet received his Aadhaar number from UIDAI, then his Aadhaar enrollment number will work.

One’s small savings account will be frozen after six months of account opening, in case the Aadhaar number or Aadhaar enrollment number is not known. For existing customers, their account will be frozen from October 1, 2023, if they fail to submit their Aadhaar number along with their small savings account within the given deadline.